Cost-Benefit Analysis Helps Managers Measure Project's Impacttest

By Andrew Gager

June 2015

Cost considerations

Start the process by making a list of all monetary costs that will be incurred upon implementation and throughout the life of the project. These include: start-up fees, including those for project teams and consultants; systems development; and implementation, training, materials, productivity lost, and relocation, among others.

Then assign monetary values to the identified monetary and non-monetary costs. To ensure consistency across the life of the project, state the monetary values in present value terms (NPV). Add all anticipated costs to get a total costs value.

Consider this example: An auto collision shop has been in business for just over two years, and business is exceeding projections. Two technicians work full-time, and the owner is considering increasing capacity to meet demand. This move would involve leasing more space and hiring two more technicians.

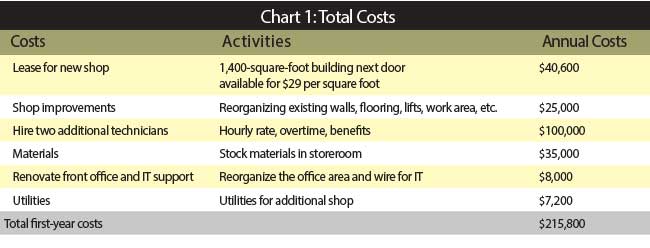

Here are several assumptions related to the example. The owner has more work than he can handle and, to keep up, is using another shop, which charges $75 an hour. The owner outsources an average of 100 hours of work each month. The owner estimates the increased capacity will increase revenue by 50 percent. Per-person production will increase by 10 percent with more working space. The analysis horizon is one year, meaning the owner expects benefits to accrue within the year. See Chart 1 for project costs.

Measuring the benefits from your project is critical and will be essential for success. Most managers fail to properly quantify benefits in terms of financial savings or revenue generation.

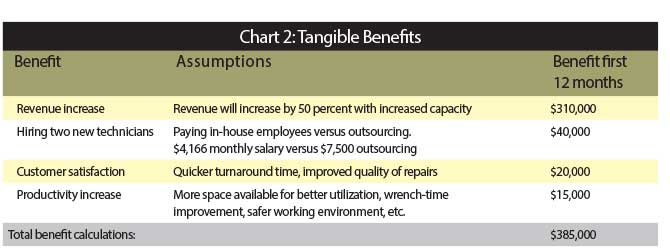

Make a list of all monetary benefits the organization will experience upon the project’s implementation and thereafter. Key areas that managers should address are: operational savings and reductions; improved customer and employee satisfaction; increased revenue; an increase in capacity and quality; and health, safety and environmental improvements. See Chart 2 for the project’s anticipated benefits.

The shop owner calculates the return on investment (ROI) will be as follows:

$215,800 / $385,000 = 0.56, or about 6 months

In our example, based on the raw numbers and an assumption, moving forward with leasing additional space is prudent. Of course, the financial benefits are best-guess estimates. Actual costs will determine true returns.

When performing cost-benefit analysis, managers need to keep several things in mind. A cost-benefit analysis is a relatively straightforward tool for deciding whether to pursue a project. To get a rough cut estimate of the ROI, list all the anticipated costs associated with the project including assumptions. Then estimate the benefits it will generate. Finally, where benefits are received over time, work out the time it will take for the benefits to repay the costs.

You might decide to include intangible benefits in the cost-benefit analysis. You might have to estimate a value for these items, so this inevitably brings more conjecture into the analysis. More sophisticated programs and tools can be used for more complicated projects, but a simple cost-benefit analysis can save a great deal of time, energy, and potentially money in the long run.

Agree? Disagree? Have something to say? We want to hear from you. Visit myfacilitiesnet.com/AndyGager, and start a conversation.

Andrew Gager — a.gager@nexusglobal.com — is a principal consultant with Nexus Global. He has more than 28 years of manufacturing and facilities experience, ranging from warehousing operations to plant management. He is a registered CMRP, CPIM and Six Sigma Green Belt, and he is formally trained in change-management principles.